UK Retailers Face £2bn Packaging Tax Challenge

Retailers in the UK are bracing for a significant financial hit as they confront a new £2 billion packaging tax. This development comes at a time when the industry is already grappling with rising wage costs and economic uncertainty. The tax aims to encourage more sustainable packaging solutions, but it also adds pressure on retailers to balance environmental responsibilities with financial viability. As businesses navigate these challenges, the impact on pricing strategies and consumer behavior remains to be seen.

- 📦 Packaging Tax Impact: The new £2 billion packaging tax is set to challenge UK retailers, pushing them to rethink their packaging strategies and costs.

- 💼 Job Cuts Loom: Amid financial pressures, 10 major retailers are planning job cuts in 2025, highlighting the tough economic climate.

- 📉 Consumer Sentiment Dips: Worsening household finances have led to a decline in consumer spending intentions, reaching a two-year low.

- 🌦️ Easter Boost: The late Easter and favorable weather contributed to a 7% rise in UK retail sales in April, offering a temporary reprieve.

- 🏬 Retail Park Resurgence: Retail parks saw a 7.5% increase in footfall, outperforming other sectors and indicating a shift in shopping preferences.

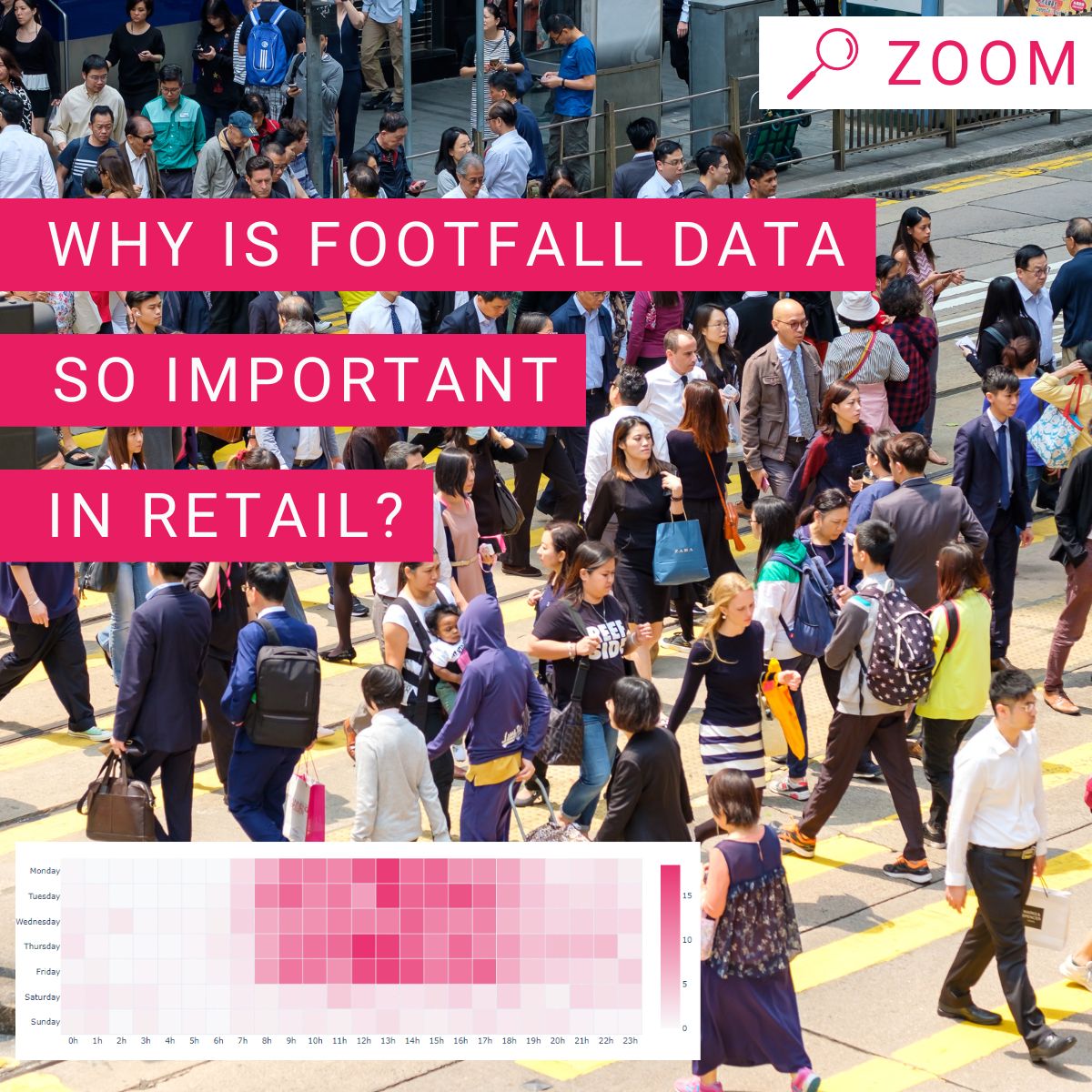

April 2024 Sees 7.2% Rise in UK Retail Footfall

– **Overall Footfall Growth**: Total UK footfall rose 7.2% from 6 April to 3 May 2024.

– **High Street Recovery**: High street footfall increased 5.3%, up from -4% in March.

– **Retail Park Performance**: Retail parks experienced a 7.5% rise from -1.2% the previous month.

Economic Worries Lead to Drop in UK Retail Sales

– **Consumer Sentiment**: Household finances worsen, leading to reduced spending intentions.

– **Job Cuts Ahead**: 10 retailers plan job cuts in 2025 amid financial pressures.

– **Sales Trends**: Unexpected retail sales drop in December linked to poor supermarket performance.

Spring Boost Drives 7% Increase in UK Retail Sales for April

– **Sales Growth**: UK retail sales rose 7% year on year in April 2023.

– **Easter Influence**: Easter’s late timing contributed to increased consumer spending.

– **Rising Costs**: Retailers face £2bn in new packaging tax and wage increases.

Retail Sales in April Show Strength Amid Ongoing Tariff Issues

– **Sales Growth**: April retail sales increased despite ongoing tariff issues.

– **Positive Forecast**: NRF projects 2025 retail sales growth of 2.7%-3.7%.

– **Consumer Spending**: Consumers maintain spending levels amid rising uncertainty.

Grocery Store Visits Climb Despite Reduced Shopping Duration

– **Increased Grocery Trips**: Shoppers are visiting grocery stores more frequently each year.

– **Shorter Visit Duration**: Consumers spend less time in-store during each grocery trip.

– **Insights from Placer.ai**: Placer.ai’s report highlights key visitation trends for grocery shopping.